We enable businesses to transfer funds for wages, pensions, employee expenses, dividends and insurance settlements to a payees’ account quickly and reliably. Here, at FastPay we offer a Direct Credit Payment service as part of our Bureau Service.

Debit credit difference full#

Direct Credit brings direct time and efficiency savings cutting down on the admin workload whilst giving businesses full control over their cash flow. It is the most popular method to pay staff wages and salaries 90% of the UK workforce gets paid this way. What are Direct Credit Payments?Īs highlighted by the earlier example, Direct Credit payments are a simple and secure way to make business payments. The functions they perform are polar opposites. Think of the difference this way also: a Direct Debit is automated electronic withdrawal a Direct Credit is an automated electronic deposit. Hopefully by now, you can see that Direct Debits and Direct Credit should not be confused.

Is Direct Debit and Direct Credit the same? By comparison, 150,000 organisations in the UK use Direct Credit to pay staff salaries. In simple terms the difference between Direct Debit and Direct Credit breaks down to this:ĭirect Debits are payments into a business (money in)ĭirect Credits are used by businesses to make a payment (money out)įor example, many gyms, clubs and care homes use Direct Debit to collect regular or recurring payments from their clients.

In this article, we’ll address the differences between the two and provide example scenarios of where they should be used. Yet in truth, Direct Debits and Direct Credits are fundamentally different and serve distinct purposes.

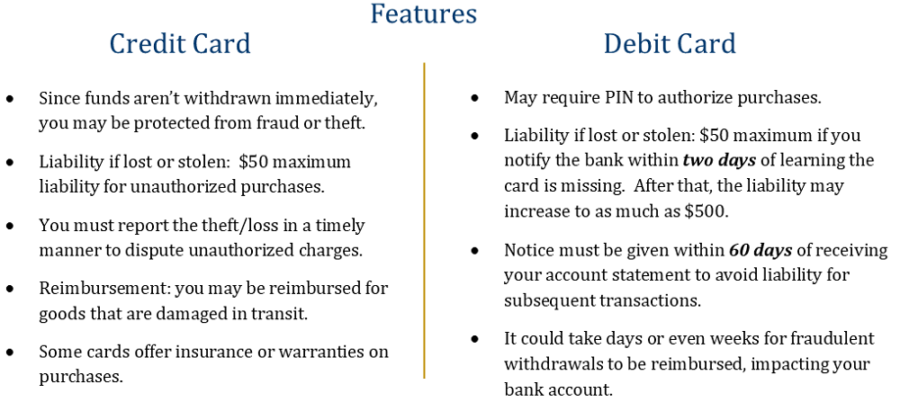

Not only do they look and sound alike, they are both Bacs payments. At the end of the billing cycle, one gets a billing statement for the total amount as well as any interest applicable.Blink and you could be forgiven for thinking that “Direct Debit” and “Direct Credit” are one and the same. Credit cards also allow one to make purchases, however, the bank account is not debited, but instead the credit card account is credited with the purchase. The difference between debit cards and credit cards is that the debit card allows the account holder to withdraw money from his account or make purchases, where the cost will be automatically debited from the account. The terms, debit and credit are also used in the case of cards, i.e. When he withdraws money or makes a purchase, his account gets debited, but his cash in hand or his assets (i.e. For example, take a customer's bank account, when the customer deposits cash into his bank current account, his account gets credited, however, what he fails to understand is that his cash in hand gets debited. What many people fail to understand is that every credit and debit transaction has a corresponding debit or credit transaction. In financial accounting or bookkeeping, "Dr" (Debit) is the left side of a ledger account or when something has been deducted from the account, whereas "Cr" (Credit) is the right side of a ledger account, when something has been added.ĭue to this many believe that since credit adds, so it is good, whereas debit deducts, so its bad.

Debit credit difference how to#

0 kommentar(er)

0 kommentar(er)